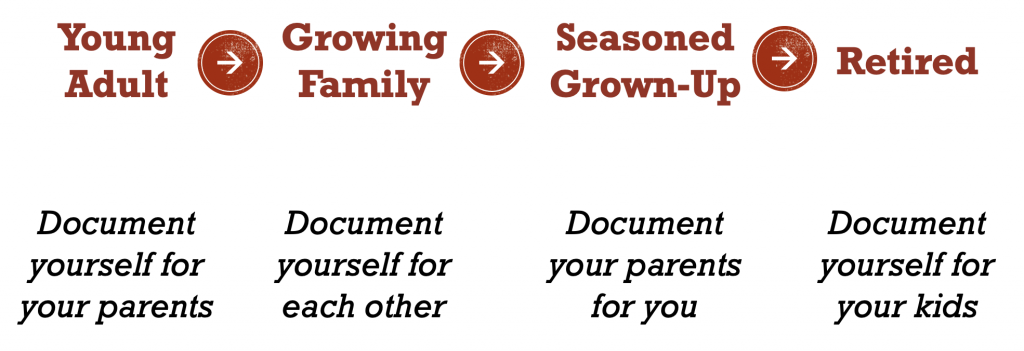

I’ve come to realize that everyone needs to plan to “Finish Well”, whether you are a young adult, a growing family, a “seasoned” grownup, or are retired.

The benefits? The frequencey? Read on!

When starting Finishing Well, the primary audience was older, retired couples so that a spouse could:

provide peace-of-mind to your loved ones when you die; that they know what to do, how to process difficult tasks, how to take over your finances, your house, etc. In a nutshell, it’s about helping those you love to shut down the life engine you’ve spent 90 years perfecting.

Now, however, it is clear to me that everyone should plan to finish well. I don’t think it’s morbid at all to think of this. In fact, I think it’s quite healthy, just like buying life insurance, planning for retirement, saving for a dream vacation, or even saving for a long-desired gift that you give to your loved one.

In fact, that’s exactly what completing your Finishing Well Plan of Action is…a gift.

…and it’s not a lame gift! I’m sure you’re thinking, “Hey, loved one, don’t forget I’m going to die some day, and I’ve picked you to shut down my life! Have fun!”. But it’s not that at all.

Take a look at these four personas and their actions…and who they are providing this amazing gift to.

Young Adult

You are on your own! Your parents or guardians have provided for you and you have launched into this amazing world. Adventure awaits! Along with love, heart-break, and a unique journey that is all your own, you have a great apartment, a dog, a cool job, and close-knit friends where you all travel this life together.

Document yourself for you & your parents

But what happens if tragedy strikes? Who gets the dog? Who notifies your boss? What about the retirement account you’ve started?

Certainly your friends will grieve, but your parents will be devastated. During this horrible time, would you rather they spend hours and weeks working through bills, banks, investments, landlords, on their own, or would you rather you gift them with a roadmap, a check-list they can follow “without thinking” to shut down your life?

Tip: The Finishing Well plan benefits you as well! You feel organized, it’s easier to find your passwords, accounts, frequent flyer numbers, everything you need is at your fingertips!

Growing Family

You found your person, and you share everything, go everywhere, and do it all. Soon you start your family and everything speeds up. You’re on a shoe-string budget but it’s lovely, and you are writing a beautiful story.

Document yourself for each other

So, tomorrow, when your story ends, what will your spouse do? How will that person process what you’ve started to create together? Did you even have life insurance, retirement accounts, what about the passwords to all the subscription services you’ve set up to make it “simpler” for them?

Your family has many years ahead of them, and you can start their new journey by gifting them with a check-list to end this chapter with peace-of-mind and start a new one. Or, your chapter could end in anxiety, anger, and the kind of stress you wouldn’t wish on anyone.

Seasoned Grown-Up

Welcome to the “Sandwich” generation! You not only still love and care for your grown children, you now care for your parents. You now get to live out two scenarios:

Document yourself for each other & your kids

This is much like the “Young Family”, and hopefully you started early so it’s just an annual refresh. Your spouse, and your kids, in the event of a tragedy, will be so grateful that while they grieve, they have a check-list they can follow and have the peace-of-mind you gifted them.

Document your parents for you

This is where you get to also document your parents for your eventual use. We went through this ourselves, and is tricky. Your parents are older, sometimes not mentally sharp, and you need to start taking over their life engine. The sooner the better because passwords, bank accounts, and the intricate knowledge of how they get and give money every month slips away faster than you would like.

But this is critical. While you didn’t sign up for it, you will be responsible for their daily living (even if you are far away and manage their finances while they stay in assisted living).

It is essential that every person entering assisted living have a Finishing Well plan of action, not for them, but for their spouse/kids that will take over.

Retired

You’ve made it! You are now retired and can start doing all the things you didn’t have time for. With this new-found time (that I’m told gets filled very quickly), dedicate some for your Finishing Well plan. Your spouse and kids will be so thankful.

Document yourself for each other & your kids

This is especially important now that potential assisted living, long term care, medical changes and decisions, (and other realities of retirement that are not part of the brochure!), all come into play. In the event you can’t make those decisions on your own, you need to document how your spouse and kids can take over.

We have found personally that this eases so many issues: being able for your loved ones to take over like a gentle slope, while still difficult to accept, is far better than not having help along the way.

When to Plan?

Regardless of which persona you most relate to, the answer to “when should I start my Finishing Well plan” is easy:

Start Now

See? simple!

Oh, and this is also a gift to yourself. I promise you that once you fill out your Finishing Well plan of action, you will have a greater sense of purpose. You will see your life with more clarity, and any gaps will come to light. Don’t think of it as just something that benefits others once you’re gone.

In a future article, I’ll go into tips on how often to update, and tricks I’ve used. I hope you find some inspiration in this, and get started.

Questions? Comment below! or email at FinishingWellPlan@gmail.com